Home Strategies

Strategies

Short Squeeze and Long Squeeze: Trading Methods

A squeeze is where the market is moved to an extreme value in a short space of time. These moves are often temporary, and so they can create some good trading opportunities for turning a quick profit.

A Simple Turtle Trading System

The basic aim of “the turtle” is to enter trends at the early stages - it uses range breakouts to time these entries.

Trends + Breakouts = Profits: What the Turtle Trading System Can Teach Us

In the early 1980’s an experiment took place to find out if it is possible or not to take a bunch of ordinary people off the street and turn them into trading moguls.

How to Recover a Losing Trade and Come Out with a Profit

We all have to deal with losing trades at some point or other. But the question of what to do when this situation arises can pose several challenges. When confronting a losing trade we face three possible choices.

Can You Trade More Profitably Without Stop Losses?

Trading without stop losses might sound like the riskiest thing there is. A bit like going mountaineering without safety gear. But what's the reality?

What are the Alternatives to the Yen Carry Trade?

The carry trade has a simple aim: Borrow low and lend high. Japanese yen is often the borrowed currency in carry trades. This is because it’s cheap.

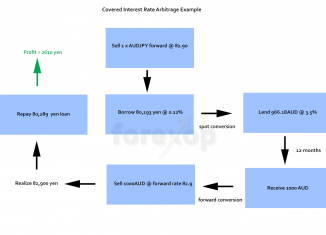

Covered and Uncovered Interest Arbitrage Explained with Examples

With covered interest arbitrage, a trader is looking to exploit discrepancies between the spot rate and the futures or forwards rate of two currencies. This allows the trader to borrow or lend at below market or above market rates respectively.

Day Trading with Pullbacks – Thinking Ahead of the Crowd

One of the ways to succeed in trading is to predict the market by thinking “ahead of the crowd”. When doing this an uptrend can mean a selling opportunity. A downtrend can mean a buying opportunity.

Why Most Trend Line Strategies Fail

Trends are all about timing. Time them right you can potentially capture a strong move in the market. Time them wrong and you’re likely to lose money.

3 Yen Trades that Make Money

This post looks at three alternative strategies that you can use to trade Japanese yen. Yen has some unique attributes that set it apart from other currencies. It is the third most traded currency after the US dollar and the euro.